how to lower property taxes in nj

If New Jersey switched all local employees to such a gold plan governments could cut property taxes by nearly 9 percentthats 25 billion in spending at the county and local levelwhile still providing health benefits on the high end. The property tax then becomes a lien on your house which gathers interest as long as it.

Why Are Nj Property Taxes So Incredibly High When It Is The Most Densely Populated State In The Country Shouldn T Nj Residents Pay Less Property Tax Since There Are More People Per

That equals 07 less than 1 of all New Jersey towns have property tax burdens below the national average.

. Lower property taxes to make home ownership more affordable New Jersey can and should be a place where our residents can afford to live and work for generations. New Jersey doesnt have to continue to be the butt of jokes and derision by the leaders of more fiscally disciplined states. Here are five interventions to cut spending and reduce property taxes.

These are designed to provide relief to homeowners who are paying a large portion of their income to property tax by capping your tax bill at a certain percentage of your income. Tax refund ahead sign. New Jerseys real property tax is an ad valorem tax or a tax according to value.

The measure would change the deduction for rent payments considered as property taxes from 18 to 30. For example if your tax ratios are 2486 2925 and 3364 then divide them by 100 to get 2486 2925 and 3364 Now they are between. Tax Account InquiryPrint a Tax Bill.

Here are the programs that can help you lower property taxes in NJ. Property tax exemptions for. ACH is now available.

You will always compare your base year to your current year property tax amount. The base year will not change unless your property tax amount is less than the base year. Imagine that the taxable value of your home is 300000 and the tax rate is 10 for every 1000 of taxable value.

NJ has certain programs that can help you reduce your property taxes. Property Tax in New Jersey. Give the assessor a chance to walk through your homewith youduring your assessment.

Only four of New Jerseys 564 municipalities Teterboro Lower Alloys Creek Woodbine Camden have property tax bills below the US. If the current year is higher you get the difference as your reimbursement. It allowed us to create a login and enter the evidence including.

The costs are way out of line with private sector plans Byrne said. A deferral means you can delay paying property taxes as long as you meet the age and income guidelines. Find the three tax ratios for your city.

Short of moving to a smaller home or another state appealing the assessment of a property is how homeowners can lower their tax bills said Anthony DellaPelle a partner at McKirdy Riskin Olson. Click here for application. As Governor I will lower your property taxes through comprehensive reform of our broken school funding formula a system where 60 of state aid goes to just 5 of the districts is unsustainable Jack.

On the towns website we quickly found the link to enter an online appeal with the countys board of taxation. The taxing authorities multiply the taxable value of a home by the tax rate to arrive at the tax owed. ChokkicxDigitalVision VectorsGetty Images 21 states offer what is known as a circuit breaker tax credit.

Give power back to the people of New Jersey New Jersey voters tried unsuccessfully in 1981 in 1983 and again in 1986 to. If these three ratios are not between 0 and 1 then divide them by 100. 830 am - 430 pm Monday - Friday.

And those towns in New Jersey that are cited among the lowest. The exact property tax levied depends on the county in New Jersey the property is located in. Hunterdon County collects the highest property tax in New Jersey levying an average of 852300 191 of median home value yearly in property taxes while Cumberland County has the lowest property tax in the state collecting an average tax of 374400 213 of median.

All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land. As one example property taxes could be reduced by over 8 simply by aligning public employee health benefits and retirement savings plans to what the rest of New Jerseyans feel lucky to receive from their employers. 250 veteran property tax deduction 100 disabled veteran property tax exemption Active military service property tax deferment 250 property tax deduction for senior citizens and disabled persons NJ Veterans Property Tax Exemption.

250 deduction for veterans. Click on your county. Go to the New Jersey Division of Taxation website through the link in the References section.

The standard measure of property value is true value or market value that is what a willing knowledgeable buyer would pay a. Your county tax board can adjust this percentage figure which is also known as the assessment ratio. And this week it came to light that Kevin Corbett the head of NJ Transit was also a beneficiary of the program cutting his tax bill on.

Dont build or make changes to your curbside just before an assessment as these steps may increase your value. Ad Win Property Tax Appeals For Residential Homes Business Owners. Free Mind Map Overview For Winning A Property Tax Appeal Guide Worksheets Comparables.

Rasmussen said the average New Jersey renter who pays 1500 per month 18000 annually in rent would be able to deduct 2100 more than they would under current law.

Property Taxes By State Embrace Higher Property Taxes

Why Do New Jersey Residents Pay The Highest Taxes Mansion Global

Nj Property Tax Relief Program Updates Access Wealth

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

State Corporate Income Tax Rates And Brackets Tax Foundation

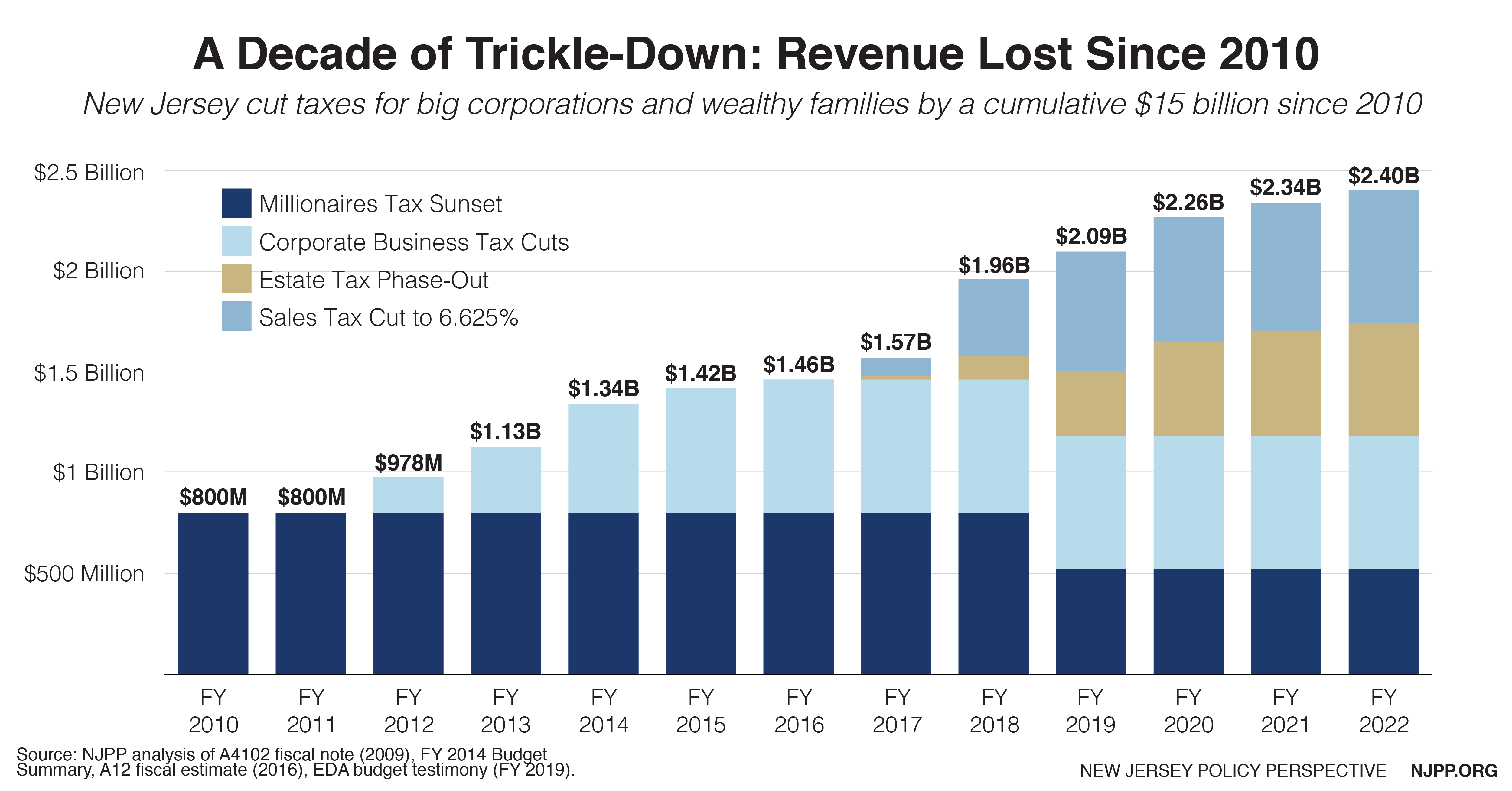

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

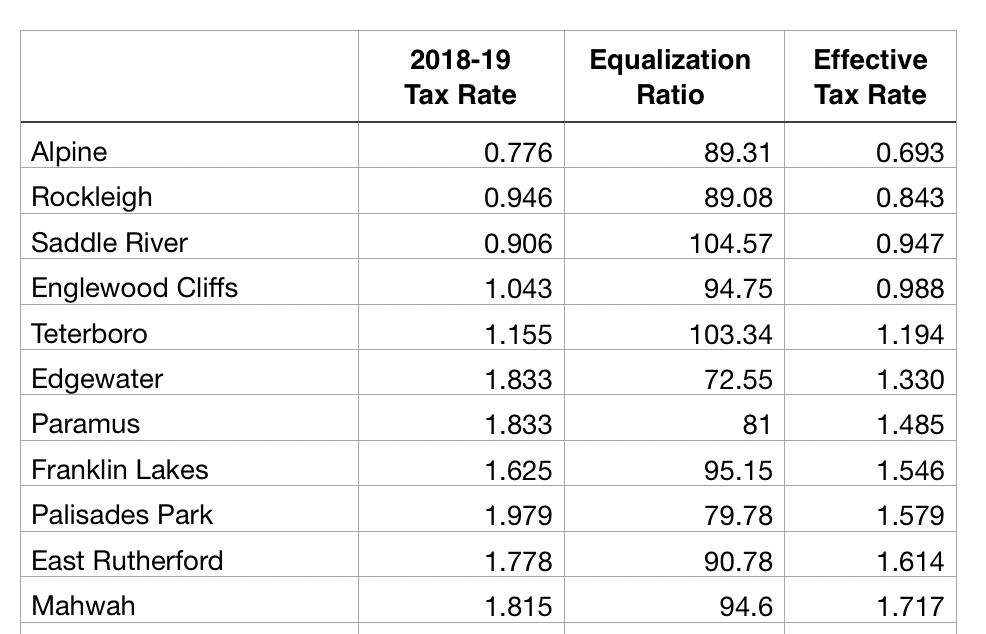

Bergen County Tax Rates For 2018 2019 Michael Shetler

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

In One Chart Jersey City S Seismic Change In Tax Levies Fully Funds The Schools And Reallocates Property Tax Civic Parent

Lower Property Taxes Jack Ciattarelli For New Jersey

10 Us Cities With Highest Property Taxes Infographic Property Tax Data Visualization

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

Deducting Property Taxes H R Block

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

My Nj Tax Return Not Picking Property Tax Deductio

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective