michigan gas tax increase 2021

Thus far in 2021 two statesColorado and Missouri have raised their state gas tax although technically it was a fee in Colorado. 0183 per gallon.

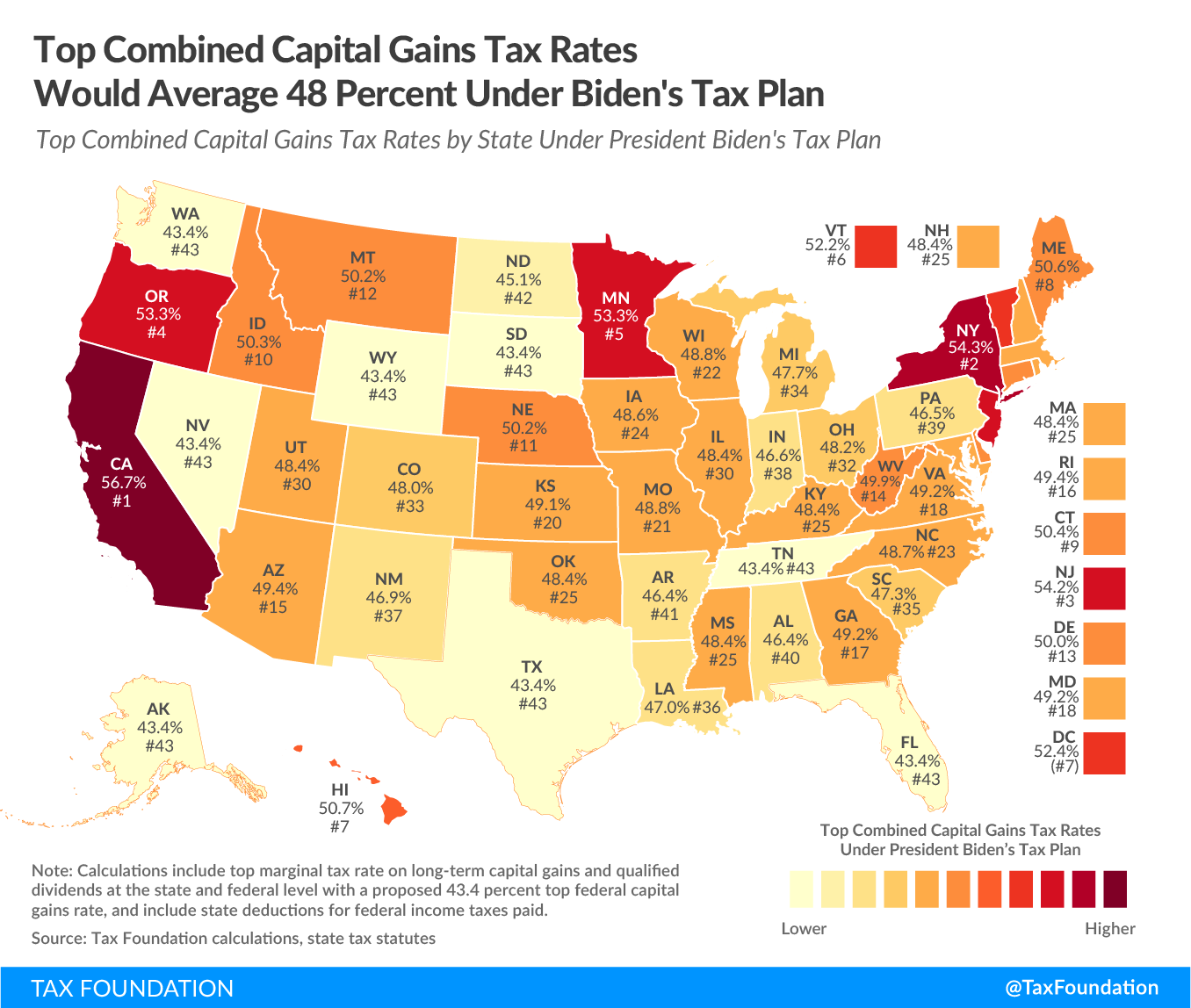

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

A 45-cent tax increase per gallon of gas.

. Additional millage information can be found on our eEqualization website. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. Gasoline 263 per gallon.

7 questions about Gretchen Whitmers Michigan gas tax increase. Utahs gasoline tax saw a small increase in 2021 by 3 cents for every 10 gallons. Map shows gas tax increases in effect as of March 1 2021.

Motor fuel taxes are levied on quantity. With the recommendation that the bill pass. Official Text and Analysis.

Previously repeal annual gas tax COLA Introduced by Rep. Alternative Fuel which includes LPG 263 per gallon. Net income tax revenue totaled 13 billion in June 2022 a 121 increase from June 2021 and 724 million above the forecasted level.

4198 cents per gallon 140 greater than national average 2021 diesel tax. The current state gas tax is 263 cents per gallon. Passed 36 to 0 in the Senate on October 20 2021.

Michigan Gas Tax Increase on Audacy. Liquefied Natural Gas LNG 0243 per gallon. For fuel purchased January 1 2017 and through December 31 2021.

Matt Helms 517-284-8300 Customer Assistance. Diesel Fuel 263 per gallon. The Michigan Public Service Commission today authorized a settlement agreement allowing a 925 million rate increase for Michigan Gas Utilities Corp.

Would provide in 2021 1 billion for state trunk lines and 641 million for. How much tax is on a gallon of gas in Michigan. Hawaii Illinois Indiana and Michigan apply their general sales taxes to gasoline and thus see ongoing changes in their overall gas tax rates based on changes.

Under the governors proposal a 45-cent increase would occur in three. At the beginning of the last legislative term Gov. Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential Should We Suspend Gas Taxes To Counter High Oil Prices Econofact.

After 2017 the tax was indexed to the amount of inflation. The FAQs on this page are effective January 1 2022. FOR IMMEDIATE RELEASE Sept.

Mackinac Center Policy Forum Virtual Event. In 2020 one stateVirginiaand DC. Revenue from the Michigan gasoline tax broke 1000 million for the fifth time in the last 12 months.

These interests to hike taxes meet a. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. 36 states have raised or reformed gas taxes since 2010.

Michigan Gas Tax Going Up January 1 2022. Referred to the Senate Transportation and Infrastructure Committee on October 5 2021. The bill in Virginia raised the gas tax by 10 cents.

Use the Guest Login to access the site. It will have a 53 increase due to a rounding provision specified in the calculations. The Salt Lake Tribune calculated that would amount to about.

53 rows When you add up all the taxes and fees the average state gas tax is 3006 cents per gallon as of the beginning of 2021 according to the US. Gasoline 263 per gallon. Fuel Tax Legislation.

The Michigan Legislature upped the states gasoline tax in 2017 from 19 cpg to 263 cpg after then-Gov. Various millage rate exports are available under the Review Reports section. After 2017 the tax was indexed to the amount of inflation.

Gas tax holiday until October 2022 as passed. Gretchen Whitmer proposed a large tax hike. The Michigan Legislature upped the states gasoline tax in 2017 from 19 cpg to 263 cpg after then-Gov.

10 states to have gone two decades or more without a gas tax increase. Under the governors proposal a 45-cent increase would occur in three. Listen to Free Radio Online Music Sports News Podcasts.

If by the end of September the annual inflation rate ends up similar to that of the previous six years the. Withholding payments which generally represent the. Some state and local officials are now using potential revenue losses from the COVID-19 crisis as a reason to raise taxes.

Currently Michigans fuel excise tax is 263 cents per gallon cpg. Michigan Governor Gretchen Whitmer D this week released her fiscal year FY 2020 budget bill central to which is a 45-cent gas tax increase and a new entity-level tax on unincorporated businesses. 4318 cents per gallon 141 greater than national average.

Federal excise tax rates on various motor fuel products are as follows. 2021 House Bill 5570. For the category select Excel Exports then select the desired report from the report drop-down list.

Since 2013 33 states and the District of Columbia have enacted legislation to increase gas taxes. Rick Snyder a Republican signed the increase into law in Nov. Michigan gas tax increase 2021 Wednesday June 1 2022 Edit.

Steven Johnson R on November 30 2021 To repeal an annual state gas and diesel tax increase based on the inflation rate for the past year which was imposed with a general increase in these taxes in 2015. Rick Snyder a Republican signed the increase into law in Nov. The current state gas tax is 263 cents per gallon.

To repeal a provision of the gas tax law that extends a gas tax increase to specified amounts of fuel held in storage by users or vendors.

In Redrawn Districts Macomb Once Again Could Decide Michigan Power Balance Bridge Michigan

State Corporate Income Tax Rates And Brackets Tax Foundation

Out Of Gas What Green Regulations Could Mean For Classics Hagerty Media

Michigan Gas Tax Hike Coming In 2022

State Gas Tax Increases Prices Expected To Continue To Rise Regional Kulr8 Com

State Corporate Income Tax Rates And Brackets Tax Foundation

Nationwide Gas Prices Hit All Time High Michigan Prices Nearing State Record Mlive Com

Northern Michigan Artist S Tea Towel Fundraiser For Ukraine Goes National Bridge Michigan

Are Michigan S Registration Fees On Electric Vehicles Causing It To Fall Behind Other States

These States Have The Highest And Lowest Gas Taxes As Biden Pushes Tax Holiday

Construction Costs Are Skyrocketing Should You Build A House Forbes Advisor

Whitmer Signals Veto Of Bill To Freeze State Gasoline Tax

Pennsylvania Drivers To Be Hit With Gas Tax Increase Northumberland County Dailyitem Com

Future Garibaldi Springs Park District Of Squamish Hardwired For Adventure

A Second Mortgage Record Gas Prices Strain Consumers Struggling With Rising Cost Of Living Cbc News

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

A Second Mortgage Record Gas Prices Strain Consumers Struggling With Rising Cost Of Living Cbc News

U S Weekly Jobless Claims Increase To Two Month High Trend Still Low Reuters