cost of work in process inventory formula

Work in Progress Inventory Formula Initial WIP Manufacturing Costs Cost of Goods Manufactured Cost Of Goods Manufactured Cost of Goods Manufactured Formula is value of. The work in process formula is.

Work In Process Wip Inventory Youtube

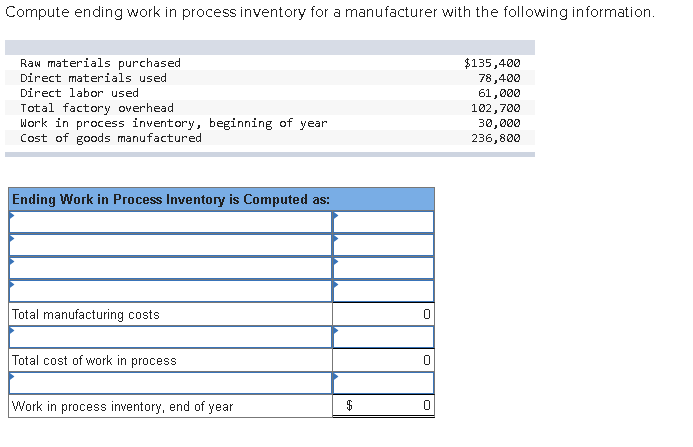

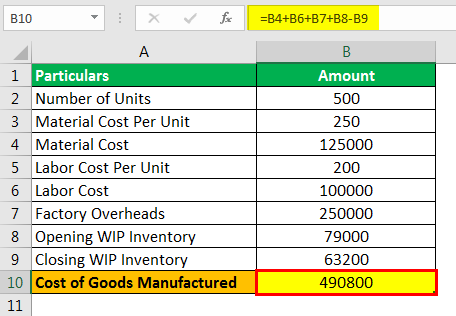

COGM Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory.

/GettyImages-975254-001-ff11e53a793446bca6e2cc49a67b29df.jpg)

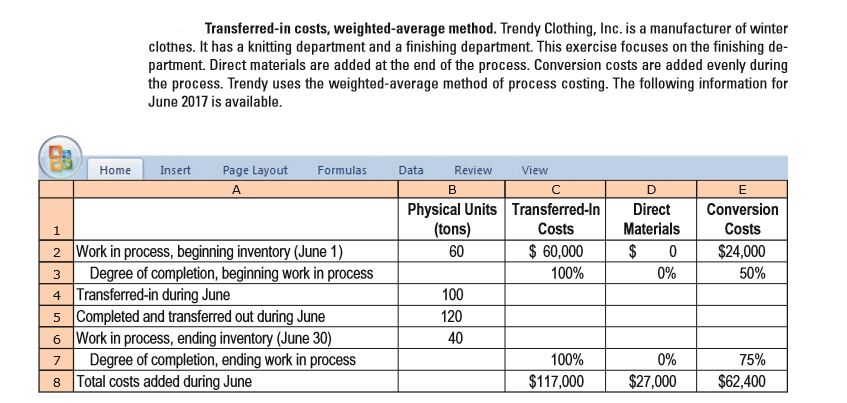

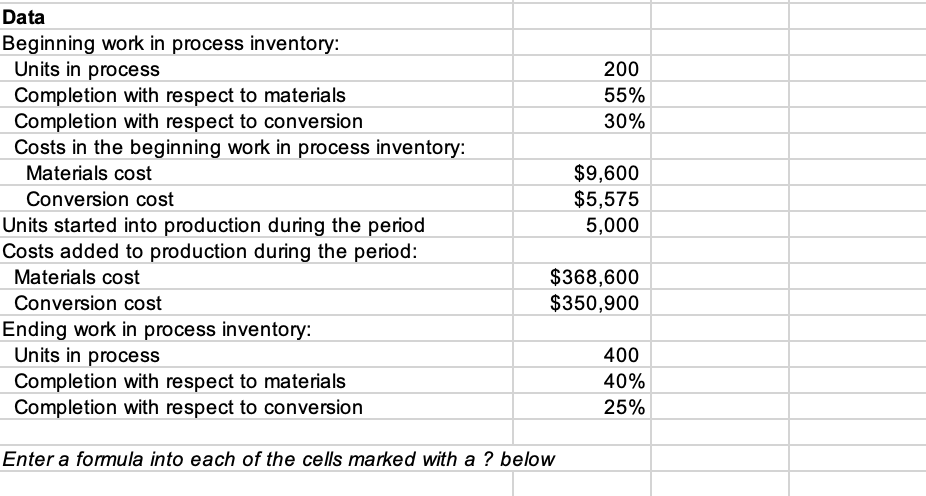

. The weighted average inventory method is an inventory valuation formula used. The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process. How to Calculate Work in Progress Formula.

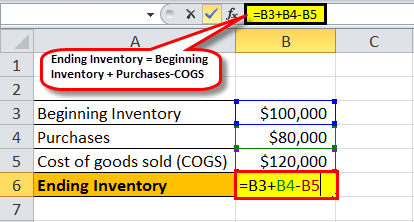

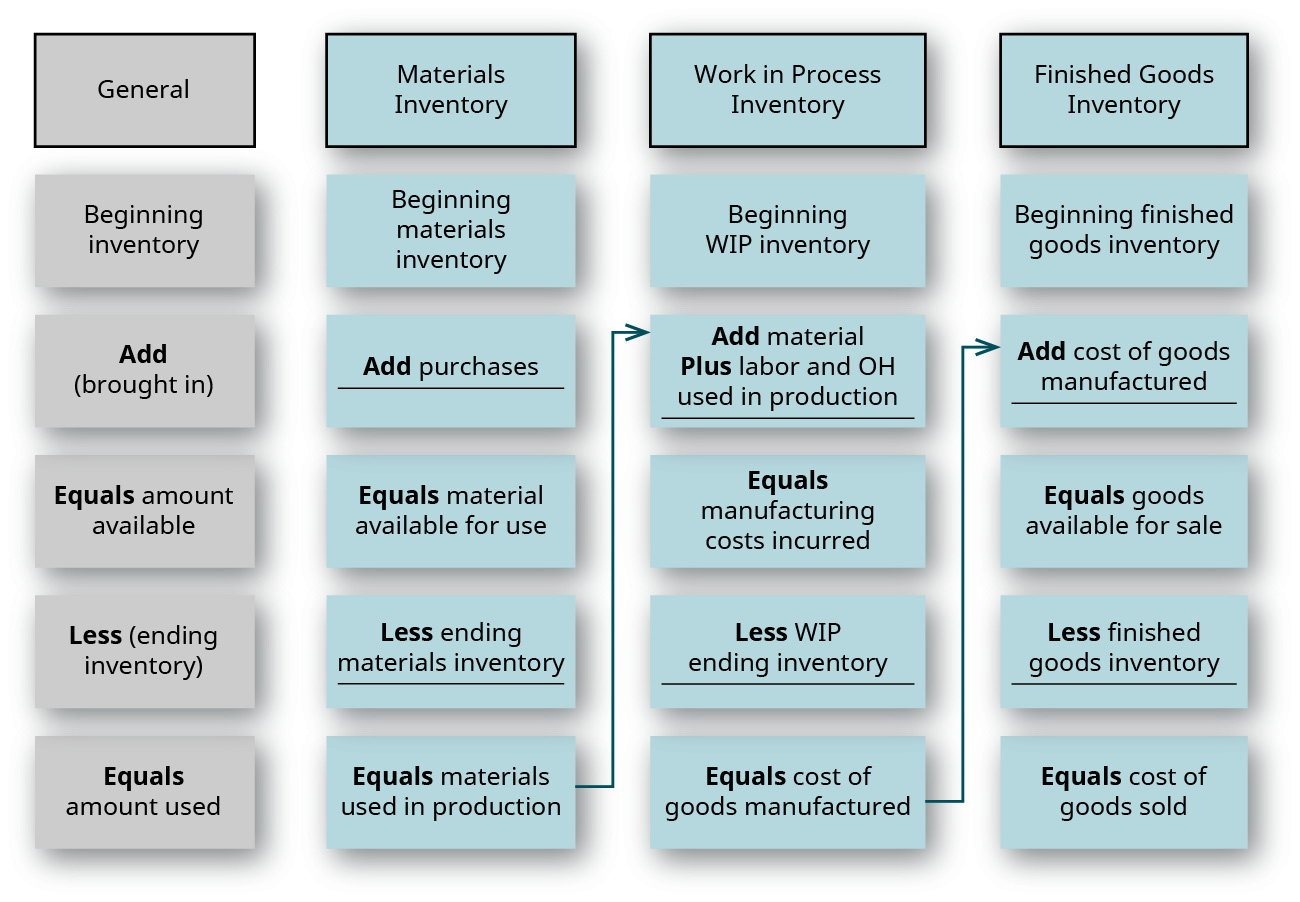

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of finished goods. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. The work-in-process inventory account shows the units that have entered the production process but are not completed.

This figure is the ending work-in-process inventory for that quarter year. Take a look at how it looks in the formula. This option is correct because.

For example suppose a companys beginning. After the beginning WIP inventory is determined. The formula is as follows.

ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the. 8000 240000 238000 10000. Work in process inventory formula.

Work in process inventory 60000. WIP beginning WIP inventory manufacturing costs COGM As a work in process inventory example lets say your company starts the year with. Costs Added during the month for Direct Materials Units Added during the month n x of completion of Direct.

This means that Crown Industries has 10000 work in process inventory with them. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs- Ending WIP. Once you have all the data.

The formula for ending work in process is relatively simple. Cost component A B C Where A units transferred out to the next departmentfinished goods. If work-in-process inventory is worth 10000 and the final value of those products upon completion is 50000 the additional 40000 in production costs must be accounted for.

Once youve determined your beginning WIP inventory and calculated your manufacturing costs as well as your cost of manufactured goods itll be easier to estimate how much WIP. Formulas to Calculate Work in Process. However by using this formula you can get only an.

This is your total cost of goods manufactured which is calculated by adding raw materials labor overhead and beginning inventory work in process inventory then. WIP is calculated as a sum of WIP inventory total direct labor costs and. How to Calculate Ending Work In Process Inventory.

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. Cost of Goods Manufactured Beginning Work in Process Inventory Total Manufacturing. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM.

To calculate your in-process inventory the following WIP inventory formula is followed. WIP e WIP b C m - C c In this equation WIP e ending work in process. The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in.

In this case for example consider any manufactured goods as work in process. WIP b beginning work in process.

What Is Work In Process Inventory Ecommerce Inventory Costs

8 6 Calculating The Cost Of A Job Financial And Managerial Accounting

What Is Work In Process Wip Inventory Definition Formula Orderhive Datosjam

Standard Costing Explanation Accountingcoach

Solved 200 55 30 Data Beginning Work In Process Inventory Chegg Com

Ending Inventory Formula Step By Step Calculation Examples

How To Calculate Ending Inventory The Complete Guide Unleashed Software

Cost Of Goods Manufactured Template Download Free Excel Template

Work In Progress Wip Definition Example Finance Strategists

Work In Process Inventory Overview Formula Examples Video Lesson Transcript Study Com

Compute The Cost Of A Job Using Job Order Costing

Inventory Formula And Calculator Step By Step

Solved Compute Ending Work In Process Inventory For A Chegg Com

Cost Of Goods Manufactured Cogm Formula Calculation

Process Costing Cost Of Ending Wip And Units T O Youtube

8 4 Tracing The Flow Of Costs In Job Order Financial And Managerial Accounting